Mastering Forex Trading with TradingView

Forex trading has gained immense popularity as a lucrative investment avenue. Among several platforms available today, trading forex in tradingview Trading Platform HK offers exceptional tools and resources for traders of all levels. With its user-friendly interface, comprehensive charting features, and a variety of analytical tools, TradingView stands out as an essential platform for Forex traders. This article will guide you through the essentials of trading Forex using TradingView, covering everything from setting up your account to implementing effective trading strategies.

Understanding Forex Trading

Forex, or foreign exchange, involves trading currencies in pairs, such as EUR/USD or GBP/JPY. Traders aim to capitalize on fluctuations in exchange rates, making profits through buying low and selling high. The Forex market is the largest financial market in the world, offering numerous opportunities for profit. However, it also comes with significant risks, requiring traders to implement sound money management practices and strategies to navigate the volatile nature of currency trading.

Getting Started with TradingView

To begin trading Forex on TradingView, the first step is to create an account. Registration is straightforward, and you can choose between a free account or various subscription plans that offer advanced features. After signing up, familiarize yourself with the platform’s dashboard and tools.

Setting Up Your Chart

One of the primary features of TradingView is its customizable charts. Here’s how you can set up your chart for Forex trading:

- Select the currency pair you want to trade by typing it into the search bar.

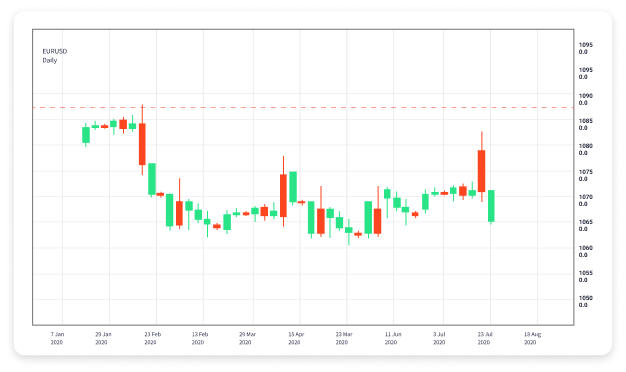

- Customize the chart type (line, bar, candlestick) based on your preference.

- Adjust the timeframe of the chart to suit your trading style (1 min, 5 min, daily, etc.).

Once your chart is set up, you can add indicators and tools to enhance your analysis. TradingView offers a wide range of indicators, including moving averages, RSI, MACD, and more, which can help you identify trends and potential entry and exit points.

Utilizing Trading Indicators

Indicators play a crucial role in technical analysis. Here’s a brief overview of some popular indicators you might consider:

- Moving Averages: These help smooth out price data to identify trends over certain periods.

- Relative Strength Index (RSI): This momentum oscillator can indicate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two moving averages.

Incorporating these indicators into your analysis can provide valuable insights and enhance your trading decisions.

Creating a Trading Strategy

A solid trading strategy is essential for success in Forex trading. Here are key components to consider when developing your strategy:

Defining Your Goals

Before you start trading, define your goals. Are you aiming for short-term gains or long-term investments? Setting clear, achievable goals will help guide your trading activities.

Risk Management

Effective risk management is vital to protect your capital. Consider implementing strategies such as:

- Setting stop-loss and take-profit orders to manage your risk effectively.

- Only risking a small percentage of your total capital on any single trade.

- Diversifying your trades to spread risk across multiple pairs.

Backtesting Your Strategy

Before deploying your strategy in a live trading environment, backtest it using TradingView’s feature that allows you to simulate trades based on historical data. Analyzing past performance can help gauge the effectiveness of your strategy.

Using TradingView’s Community Features

TradingView hosts a vibrant community of traders. Engaging with other traders can provide insights, strategies, and new ideas. You can share your ideas, follow experienced traders, or participate in discussions to enhance your understanding of the market.

Sharing Your Ideas

As you gain experience, consider sharing your trading ideas with the community. Utilize TradingView’s publishing features to post your charts and analysis. Documenting your trades can also serve as a valuable self-review tool.

Learning from Others

By following other traders, you can learn from their strategies and insights. Take time to analyze their trades, understand their thought processes, and adapt relevant strategies to your trading style.

Staying Informed: Economic News and Events

Forex markets are highly influenced by economic news and geopolitical events. Using TradingView, you can access an economic calendar that provides information on upcoming events that may impact currency movements. Staying informed allows you to make strategic decisions and anticipate market volatility.

Conclusion

Trading Forex using TradingView can be a powerful way to engage with the financial markets. By familiarizing yourself with the platform’s tools, developing a solid trading strategy, and actively participating in the trading community, you can enhance your trading skills and improve your chances of success. Always remember to practice responsible trading and stay updated on market trends and news.